September 13, 2023 – (Natural Gas Intel)

Project Canary, which moved the natural gas industry toward the ubiquitous use of “responsibly sourced gas,” or RSG, has expanded its reach to help customers measure and analyze environmental risks and emissions.

The RSG moniker made a name for the Denver-based firm, a term that often has been used interchangeably with “differentiated” or “independently certified” natural gas. However, customers and buyers now want more granular information, Co-CEO Tim Romer told NGI during a recent interview.

Romer, formerly CFO, and Co-CEO Will Foiles, who had been COO, discussed the recent retooling, which included a leadership shakeup, as longtime CEO Chris Romer, Tim’s brother, stepped aside to become executive chair.

The RSG program, which uses the TrustWell system to independently monitor emissions and improve air quality “absolutely” remains a key component of the toolbox, Romer said. The third-party verification system has drawn a bevy of gas customers from across North America and overseas, including energy majors and big Lower 48 explorers.

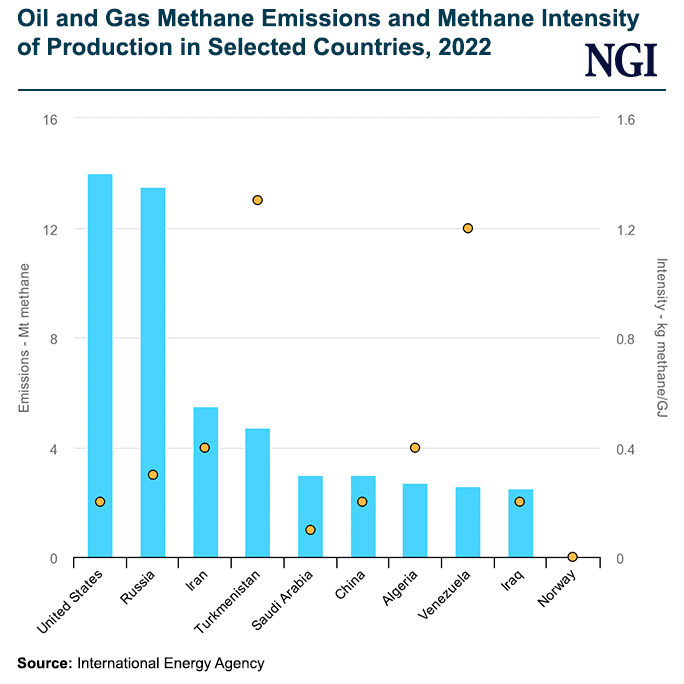

However, as the energy transition has moved toward lower carbon emissions, some companies have requested measurements of the methane and carbon intensities of their well pads. Others want precise data on processed water handling, air emissions or land impacts.

“We see companies wanting more data, more measurements, so they can make better operating decisions,” Romer said. “Other third-party stakeholders, insurance companies, investors, regulators, they all want more emissions data. So we’ve been on this journey” to respond to the market.

By integrating multiple data sources, including the use of third-party sensors, the firm is able to expand its risk assessments to include total emissions profiles. They can be tailored to what a company needs.

Differentiated Strokes

That has shifted how the global gas market defines what is an acceptable gas supply. It’s moved from wanting to use RSG “to the concept of differentiated gas,” Romer said.

Other firms that independently verify gas supply emissions data – and companies that need the information, including BP plc – have long favored using the term differentiated or independently certified gas.

Defining what is “responsible” is not easily done, Romer noted. More valuable to customers is measuring the many factors that go into how the gas is produced.

Expanding the measurement data will “make the market more robust,” Foiles said. “Some people will say, ‘I’ve got to have a methane intensity that is quantified at the pad level of no higher than 0.5%.’ This guy may say, ‘Hey, I’m okay doing subpart W estimates of methane intensity, as long as they are below 0.2%.’

“Those are two different types of gas,” he noted. “Those should be ‘differentiated.’” Relying on the definition of “certified” means it becomes a binary, “good or bad” choice.

An “informed buyer can make an informed decision that allows the operators to truly differentiate their operations, and to differentiate the molecules, which is what they want to do,” Foiles said.

“You know, responsibly sourced gas is still going to be there…We just don’t want it to be one term for the whole market…We’re trying to be the data provider to give operators more opportunity to differentiate themselves and buyers more opportunity to understand what they’re buying…That creates a better two-way market.”

Nobody can define “what is good enough,” he explained.

As an example, Foiles said, “When we think about food, we all have our own definitions of what is healthy and what is not. But at the end of the day, when you look at the food, there’s a certain number of calories. There’s a certain number of grams of sugar. There’s a protein and the ingredients that went into it. It’s just the facts, right? And then you as the consumer can say, is this healthy enough for me?”

It’s the same for natural gas supplies, he noted. Creating data “that incentivizes people to improve” is more valuable. “Very simply, natural gas is going to be here today, tomorrow and who knows how long into the future. So what can we do to help drive emissions reduction while it’s still here? That’s really all we’re trying to do.”

Documenting how the gas is produced and transported provides the customer with “everything that went into its creation, similar to that nutritional label,” Foiles said. “Every buyer has their own examples of literally what they want to see…These well sites can have dramatically different carbon and methane emissions.”

Averaging Measurements

What to do for companies that have disparate operations that may stretch from Appalachia to the Gulf Coast? In those cases, an operator may wish to use an average, Foiles said.

“We want to provide the data…We want to aggregate it out from all those well sites that feed into that pipeline, and from all the other operators, so that that pipeline operator understands exactly the well sites that the gas came from, and the carbon intensity of every single molecule that made its way to the pipeline.”

Foiles noted that certain compression facilities have reciprocating engines that are more emissions-intensive. Others use turbine engines.

“The cool part is, the same idea plays out across the pipeline…You don’t assume that every single consumer product is all the same, right? Not every single milk is the same. Not every single chip is the same. Each one comes from a different factory with different nutritional information.”

The evolution of monitoring emissions is “good for the industry,” Foiles said.

“We’re firm believers in market forces,” which rely on “transparent, reliable data…We don’t want to say ‘this is good and this is bad.’ But we can provide the information so if someone says, ‘I only care about the company average intensity, or carbon intensity,’ that’s okay. That’s their choice as a purchaser of gas…But we want to provide the information so that folks can make those decisions and people can incentivize performance.”

The cost to differentiate gas supply is “pennies” to the overall price, Romer said. Overseas buyers may be willing to pay a premium to adhere to government standards. At the end of the day, though, calculating the cost of carbon is a multi-year endeavor.

“What price do you want to put on carbon?” Romer asked. At a cost of around $30/ton carbon dioxide equivalent (CO2e), “the price of carbon is pretty low.” With the CO2e price in Europe now above $100, “these solutions cost pennies.”