Just like ESG’s meteoric rise to the top of mind among investors, the business community, the public, and stakeholders, Responsibly Sourced Gas (RSG) has also come a long way in a very short time. The RSG market was created and adopted within two short years and is now at full traction as third-party certification programs validate the environmental attributes of natural gas production and transport by requiring regular monitoring and tracking.

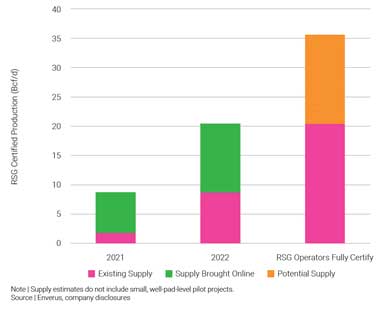

As the certification, ratings, and environmental attribute verification processes have evolved with additional measures and regulations put in place to strengthen and fortify the green credentials of RSG, the market has moved in lockstep. Enverus Intelligence Research projects supply of producer-certified RSG to grow from 8.7 Bcf/d in 2021 to more than 20 Bcf/d by the end of 2022 based on announced projects, or roughly 18% of the North American market. Furthermore, significant growth in other markets is also occurring, such as LNG to Europe, which will likely increase the final 2022 percentages.

All new industries go through crawl-walk-run stages. RSG is just starting to walk. Understanding what this differentiated gas was and how the certification process worked initially proved challenging for prospective market players. To explain the technical specifications of RSG and better understand the differences in certification methodologies, we penned this article back in autumn 2021, “What is RSG? A Definitive Guide to Differentiating Gas and the Certification Process.”

Given that Responsibly Sourced Gas and the certifiers/independent rating companies of RSG are a nascent industry, it’s understandable that some uncertainties surrounding RSG exist. In this article, we will explain how recent developments are materially reducing any uncertainties surrounding RSG and are providing a clear ‘green light’ for companies to move forward with RSG and related ESG efforts to reduce both their regulatory and financial risks.

Reducing Regulatory Risk with the Measurement Economy

The next step for RSG to go from the walk to run stage is to future-proof itself against emerging legislation. In recent years, financial titans such as BlackRock CEO Larry Fink have warned that climate risk is investment risk. Indeed, it appears that the fundamental reshaping of finance to incorporate climate risk is beginning to take root, demonstrated by the Securities and Exchange Commission’s recent proposed rules to enhance and standardize climate-related disclosures for investors. The proposed rule changes would require listed companies to include climate-related disclosures, such as greenhouse gas emissions, in their registration statements and periodic reports.

Certainly, regulation of the RSG market is moving forward at a swift pace. In a June meeting of the North American Energy Standards Board (NAESB) attended by representatives from all segments of the natural gas market as well as the Department of Energy, the American Gas Association, and Project Canary, efforts were initiated to begin creating a standardized contract addendum to support RSG trades, distributed ledgers, and smart contracts.

In another recent development, S&P Platts announced its intention to establish a market standard for Producer Certified Gas (PCG). Requirements for achieving a certification of PCG could include:

- Methane intensity of production is less than 0.10% as calculated by an independent third party

- Production volumes monitored and verified by an independent third party.

- Emissions continuously monitored production by an independent third party.

Project Canary verified environmental attributes and related certification meet Platts,’ the SEC, and the other frameworks for methane intensity thresholds including PCG and RSG tags.

At Project Canary, we have always encouraged customers to treat regulations as the low bar, not the high bar. These brewing standards are setting a new bar and making way for our customers to commit to and earn RSG verification to sell differentiated gas to ever-increasing demands from gas buyers. We believe that in the midst of the climate crisis, relying on established standards for responsible operations is not enough – we should all commit to going one step further. We strongly feel that, to avoid greenwashing and other repercussions, assessment and verification processes must be augmented with real-time data that accurately measures pad-level emissions profiles minute-by-minute, all the way down to the parts-per-billion. Project Canary’s advanced technology and team of engineers can deliver actionable insights minute-by-minute for operators instead of relying on top-down estimates every few months; they can now access high-fidelity data every minute. Methane has finally met its match – continuous monitoring.

As a result, this gives our schema a key advantage over other certification methodologies since Project Canary’s rigorous certification reporting and emissions data enables companies to understand air, community, water and land strengths and areas of opportunity for each asset, enabling companies to address issues with speed and continuously improve. What used to be a point-in-time, top-down view of operations is now an always-on emissions profile monitoring with supreme accuracy.

Reducing Financial Risk

As we edge closer toward net-zero commitment deadlines, investors, the public, and regulators are all looking for external validation of companies’ climate pledges and ESG credentials. Pressure on energy companies to reduce their environmental footprint has never been stronger, and as a result demand for third-party ‘clean molecule’ verification is soaring.

Several recent and significant transactions by utilities demonstrate the prevailing zeitgeist within the sector that RSG offers energy companies a license to operate. For instance, in 2020 French power company Engie backed out of a $7 billion deal with US LNG company NextDecade due to European pressure over the green credentials of US-produced natural gas. However in May, upon the announcement by NextDecade that it would use RSG to produce a lower carbon-intensive LNG, Engie entered into a new agreement with NextDecade to purchase 1.75 million metric tons annually of LNG produced at its Rio Grande LNG export project for 15 years.

Meanwhile, Engie announced a similar RSG deal with Range Resources, one of the largest U.S. natural gas producers focused on Marcellus Shale development. These deals highlight how companies are reducing their financial risk by ensuring the hydrocarbons they produce will be purchased by all potential markets, including buyers who are committed to and will pay for RSG.

Simply put, RSG is the most rigorous and cost-effective way to achieve ESG and climate goals, so it’s not hard to see why it continues to gain traction, especially as pressure from stakeholders continues to mount for energy companies to elevate their environmental performance.

Project Canary’s certification establishes the highest bar for validating and tracking ESG commitments for air, water, land, and community. This, in turn, reduces companies’ financial and regulatory risk while giving them the chance to ‘give the emissions the bird.’